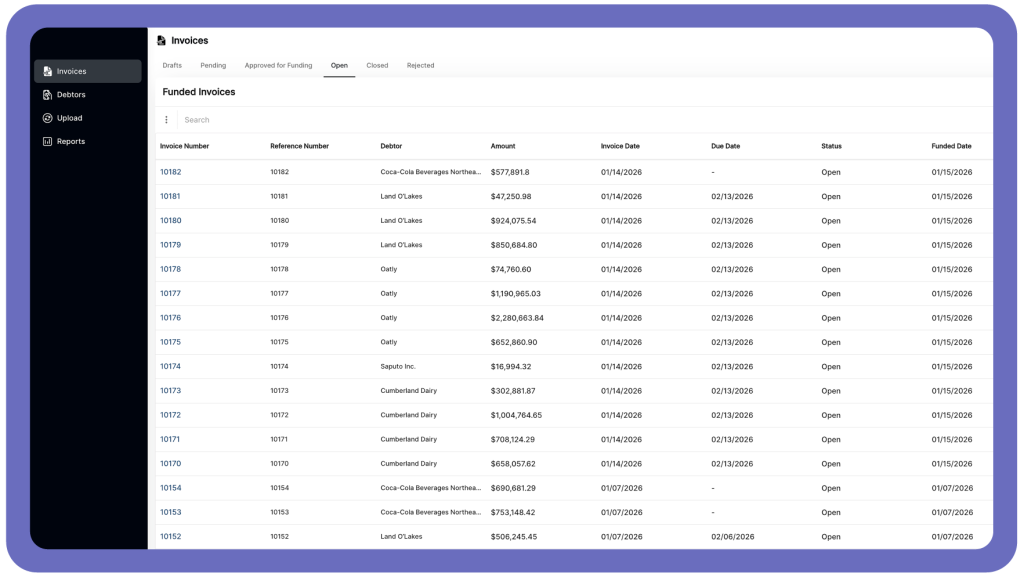

Turn unpaid invoices

into working capital, fast.

Access capital from the invoices you’ve already earned —

without taking on debt or waiting for slow-paying customers.

- Quick approvals & payout

- Flexible terms

Waiting to get paid shouldn’t

slow your business.

WideQ advances funds based on your receivables, so you can cover payroll, take on new contracts, and keep your business moving forward.

Step 01

You invoice your

customer.

Step 02

We advance you most of the invoice upfront.

Step 03

You get the rest

once the invoice

is paid.

When others say no, we say YES.

At WideQ, flexibility is how we operate. We take time to understand your business needs and find solutions that traditional lenders can’t. And because timing matters, we move fast to get you the capital you’ve earned — so your business keeps moving forward.

Why choose WideQ

Fast

Our quick, hassle-free process gets your funds to you without unnecessary paperwork or delays.

Flexible

With custom contracting from $100K—$50M, we build out a custom plan for your business.

Reliable

Our transparent, straightforward support focuses on providing you with a smooth experience.

Stability to stay steady. Freedom to take on more.

- Growth needs upfront capital — for materials, labor, and capacity. Funding helps you say yes to opportunities instead of holding back.

- Long pay cycles create strain. Turning receivables into cash keeps your business moving while you wait to get paid.

- When payments are delayed, payroll isn’t. Funding bridges the gap so your team gets paid and operations stay on track.

- Funding gives you the capacity to secure inventory, supplies, or materials when you need them — without waiting for payouts to come in.

- After a challenging period — from major setbacks to rebuilding after financial hardship — funding helps you regain balance, restore momentum, and get back on your feet.

We support the industries where dependable cash flow matters most, helping you stay ready for whatever comes next.

Healthcare

Government Vendors

ABA Services

Manufacturing

Staffing & Workforce Services

Healthcare

Don’t see your industry here? Reach out — we can likely fund it.